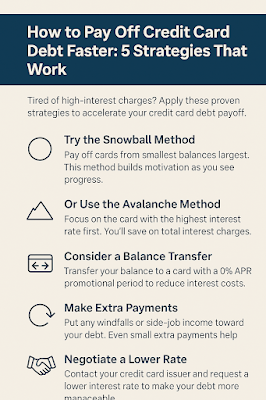

How to Pay Off Credit Card Debt Faster: 5 Strategies That Work

Credit card debt can feel overwhelming, especially with high interest rates stacking up each month. But with the right strategy and mindset, you can take control and pay it off faster than you think. Here are five proven methods to accelerate your debt payoff journey.

1. The Debt Snowball Method

List your debts from smallest to largest balance. Pay minimums on all but the smallest, which you pay off as quickly as possible. Once it’s gone, roll that payment into the next-smallest debt. This approach builds momentum and motivation.

2. The Debt Avalanche Method

List debts by interest rate, highest to lowest. Focus all extra money on the debt with the highest interest while making minimum payments on the rest. Over time, this method saves the most money in interest.

3. Balance Transfer Credit Cards

Some cards offer 0% APR for an introductory period (usually 12–18 months). Transferring your high-interest balance to one of these can give you breathing room to pay down principal without more interest piling on. Just watch for transfer fees.

4. Automate and Increase Your Payments

Set up automatic payments to avoid missed deadlines and fees. Then, gradually increase your monthly payment by $25–$50 whenever possible. Every little bit extra helps reduce principal faster.

5. Cut Spending and Apply Windfalls

Free up money in your budget by cutting non-essentials. Then, apply tax refunds, bonuses, or side income directly to your debt. These lump sums can slash months off your repayment plan.

Final Thoughts

Paying off credit card debt faster isn’t about finding a magic solution—it’s about consistent action, smart strategies, and staying motivated. Choose a method that fits your style and stick with it. Your future self will thank you.

Posted on: Saturday, 7 June 2025 at 07:00 AM (Thailand Time)

Comments

Post a Comment