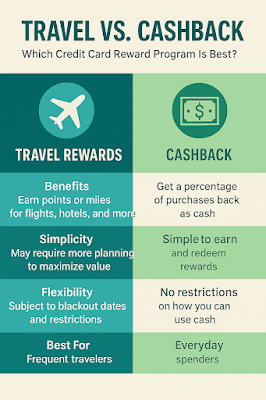

Travel vs. Cashback: Which Credit Card Reward Program Is Best? Credit card rewards come in many forms, but the two most popular are cashback and travel rewards. Each has its pros and cons—and the best choice depends on your spending habits and lifestyle. What Are Travel Rewards? Travel rewards cards allow you to earn points or miles that can be redeemed for flights, hotel stays, and more. Some cards are co-branded with airlines or hotel chains, while others offer flexible points that can be used across travel platforms. What Is Cashback? Cashback cards return a percentage of your spending—usually between 1% and 6%—as a statement credit or cash. They’re straightforward and easy to use, with no need to track miles or blackout dates. Comparison: Travel vs. Cashback Value: Travel rewards can offer higher value if used strategically (e.g., 2 cents per point on flights), but cashback is guaranteed and flexible. Complexity: Travel rewards often require ...